Home > EITC

The Earned Income Tax Credit (EITC) could give you a financial boost when you file your taxes. People who receive the Vermont EITC are automatically eligible for 3SquaresVT!

To claim the EITC, you will need to file a tax return by April 15, 2025 even if you aren’t required to file this year. If it’s your first time filing taxes or you need help filling out the form to claim your tax credit, there are free resources and IRS-certified volunteers who can help!

Dial 2-1-1 to make an appointment with CVOEO if you live in Chittenden or Addison County —it’s free!

Visit GetYourRefund.org to have an IRS-certified volunteer file your taxes for free.

Visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

Can I get the EITC?

Eligibility for the state and federal EITC are the same, and you could get both credits by filing state and federal taxes. You will need to file a state and/or federal tax return, even if you do not owe any tax or are not required to file. Learn more about the Vermont EITC here.

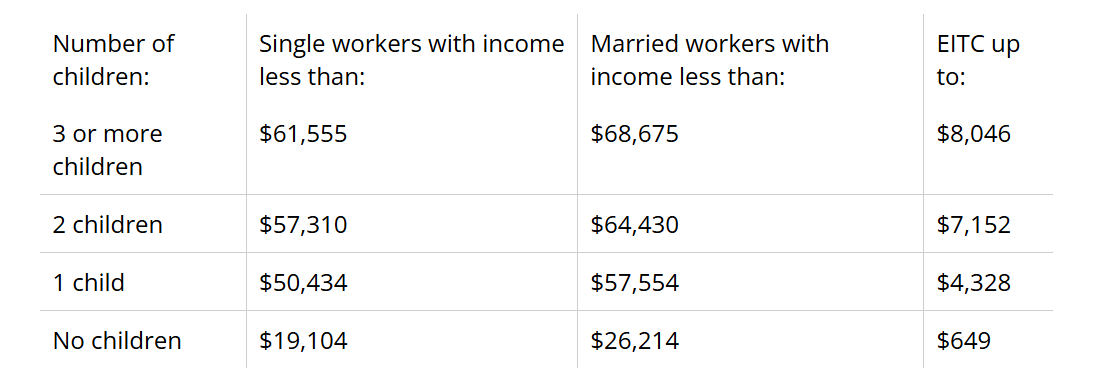

Eligibility is based on income, household composition, and number of dependent children.

Claiming qualifying children on the EITC may increase your credit, however you don’t need to have children to claim the EITC.

If you have no children (or no children who qualify under EITC rules), you may qualify if you are 19 years or older and not a student.

Please note, qualified homeless youth or former foster youth who are at least 18 years old and work are eligible even if they are a student. For a complete list of eligibility, visit taxoutreach.org.

Source: www.taxreachout.org

Working families with children who receive the state EITC are automatically income eligible for 3SquaresVT. You will still need to apply to receive 3SquaresVT benefits—be sure to answer YES to Question #6 on the 3SquaresVT application.